The “Record to Report” process, also known as “Account to Report” or simply General Ledger process, refers to the maintenance of general ledger law from the recording of transactions to the preparation of trial balances for the transaction. unit and consolidated financial results of the reporting company.

Bookkeeping is an essential accounting activity that provides the solid financial foundation on which an organization rests. The accuracy and integrity of the financial statements an organization produces largely depend on the accuracy and integrity of its record keeping activities. Entering journals and reviewing and posting to ledgers are the two main bookkeeping activities. Logs are where all transactions are first recorded on a daily basis. Information from a journal is then recorded in ledgers to update each account. Various accounts in the ledgers are then summarized, tested and validated, and used to produce financial statements at the end of an accounting period.

Here we will help you understand basic accounting concepts and introduce you to the process of entering journals, reviewing, summarizing entries, reconciling, and finally reporting and closing an accounting period. This section of will help you understand the fundamentals of an effective automated general ledger system and the concepts explain all the important GLs including how to analyze a transaction, post it to the appropriate journal, and then view it in great books. We assure you this is the best place to learn the registration process to report!!

The funds contributed by the owners of any business are different from all other types of funds. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. Funds contributed by strangers other than the owners payable to them in the future. Liabilities are generally classified into short-term (current) and long-term liabilities. Current liabilities are debts at less than one year.

Modern business organizations operate globally and rely on a large number of registered legal entities, and operate through complex matrix relationships. To remain competitive in today’s global business environment, they often must develop highly diverse and complex organizational structures that cross international borders. Learn more about legal entities and their importance to businesses.

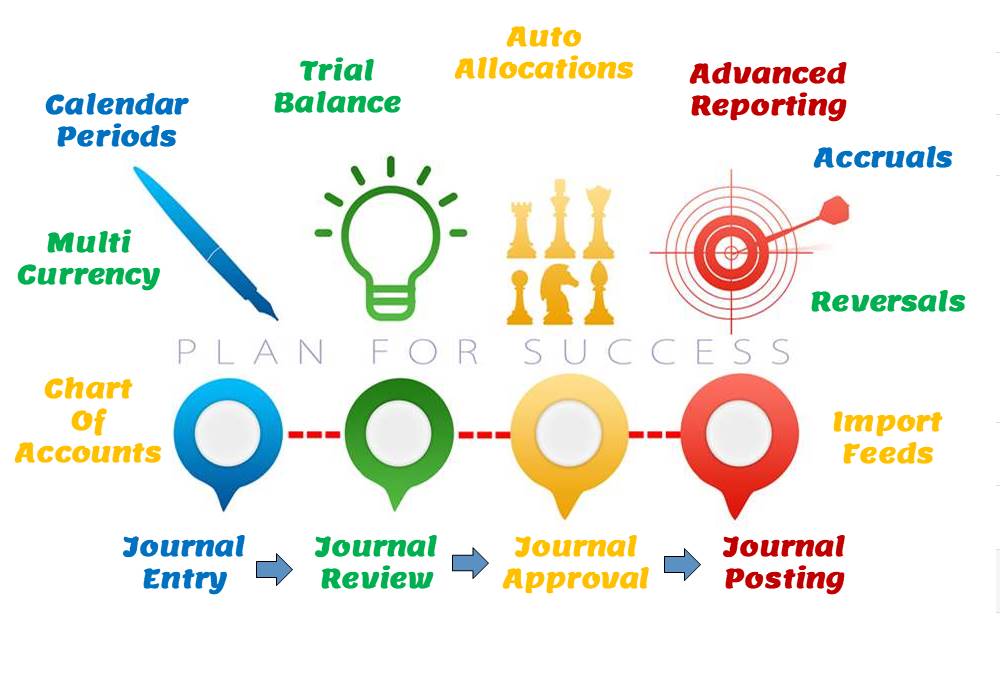

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can generate reports for multiple legal entities from a single system. These systems offer many advanced features ranging from log capture to advanced reporting. This article will provide an overview of some advanced features available in Ledgers today.

One of the biggest benefits of using a double-entry bookkeeping system is the ability to generate a trial balance. What do we mean by trial balance? As its name suggests, a trial balance is a report whose debits must equal credits. Understand the importance of the trial balance and why it is balanced. Learn how it is prepared and in what format.

In this article, we will focus on and understand the accounting process that allows the accounting system to provide the necessary information to business stakeholders. We will go deeper into each of the accounting steps and understand how to identify accounting transactions and the process of recording accounting information and transactions.

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the prerequisites for starting the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

In this article, we will help you understand the double-entry bookkeeping system and state the accounting equation and define each element of the equation. Next, we will describe and illustrate how business transactions can be recorded based on the resulting change in the elements of the accounting equation.

For any business that has a large number of transactions, putting all the details in the general ledger is not feasible. Therefore, it must be supported by one or more subledgers that provide details of general ledger accounts. Understand the concept of subledgers and control accounts.

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, Subsidiary Projects Ledger, Subsidiary Work in Progress Ledger, and Receipts or Subsidiary Payments Ledger.