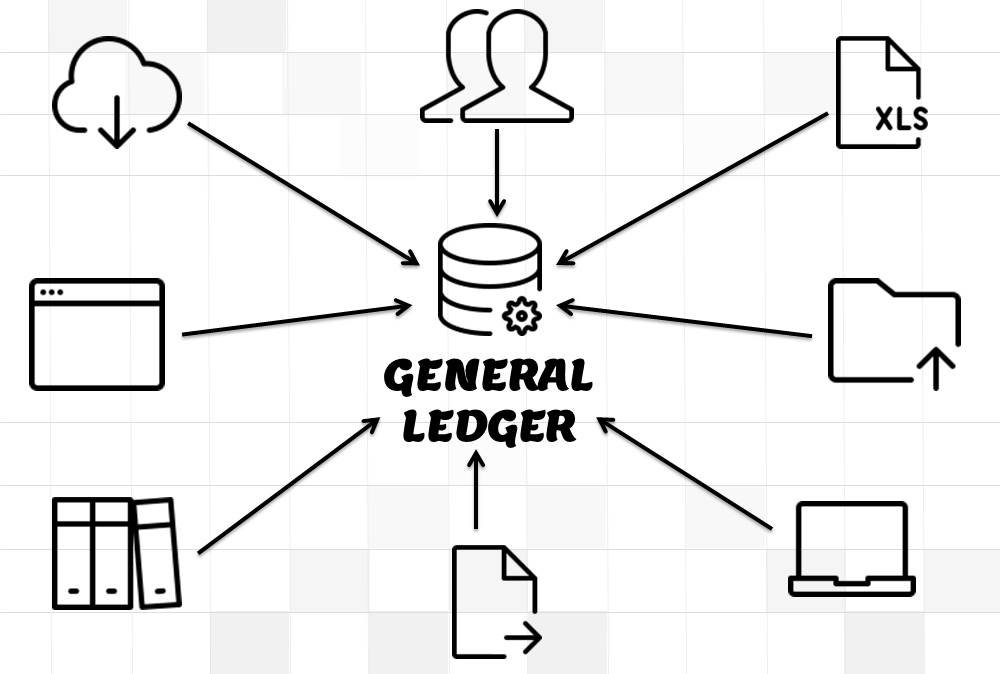

The “Record to Report” process, also known as “Account to Report” or simply General Ledger process, refers to the maintenance of general ledger law from the recording of transactions to the preparation of trial balances for the transaction. unit and consolidated financial results of the reporting company.

Bookkeeping is an essential accounting activity that provides the solid financial foundation on which an organization rests. The accuracy and integrity of the financial statements an organization produces largely depend on the accuracy and integrity of its record keeping activities. Entering journals and reviewing and posting to ledgers are the two main bookkeeping activities. Logs are where all transactions are first recorded on a daily basis. Information from a journal is then recorded in ledgers to update each account. Various accounts in the ledgers are then summarized, tested and validated, and used to produce financial statements at the end of an accounting period.

Here we will help you understand basic accounting concepts and introduce you to the process of entering journals, reviewing, summarizing entries, reconciling, and finally reporting and closing an accounting period. This section of will help you understand the fundamentals of an effective automated general ledger system and the concepts explain all the important GLs including how to analyze a transaction, post it to the appropriate journal, and then view it in great books. We assure you this is the best place to learn the registration process to report!!

In each recorded journal entry, the debits and credits must be equal to ensure that the accounting equation matches. In this article, we will focus on how to analyze and record transactional accounting information by applying the credit and debit rule. We will also focus on some effective methods of recording and analyzing transactions.

Review and approval mechanisms ensure that the accounting transaction is reasonable, necessary and in accordance with applicable policies. Understand why we need review and approval processes, what they are, and how they are performed in automated general ledger systems. Discover the benefits of setting up journal approval mechanisms.

In some ERP tools, there are more than 12 posting periods in a fiscal year. This article discusses the concept of accounting calendar and accounting periods. Find out why different companies have different accounting periods. Understand some of the periods commonly used in different organizations and the definition and use of an adjustment period.

The method of accounting refers to the rules followed by a business to report its income and expenses. Understand the two common accounting systems, single-entry and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual accounting methods and the advantages and disadvantages of their use.

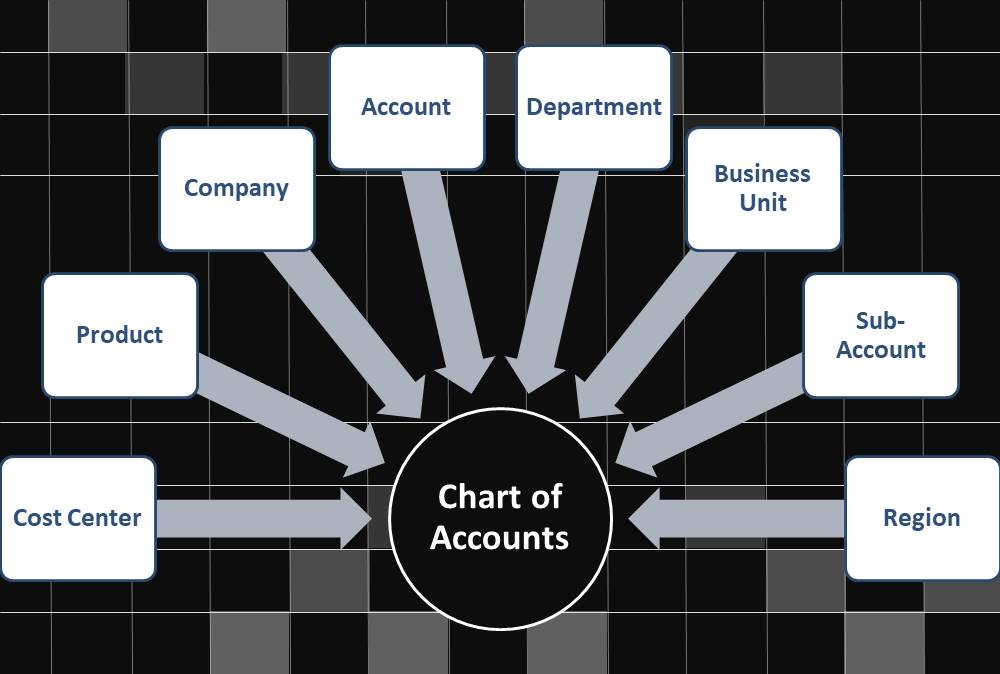

A chart of accounts (COA) is a list of accounts used by a business entity to record and classify financial transactions. COA has evolved from legacy, capturing only the natural account, to modern multi-dimensional COA structures capturing all accounting dimensions related to the underlying data allowing a granular level of reporting. Learn more about the role of COA in modern accounting systems.

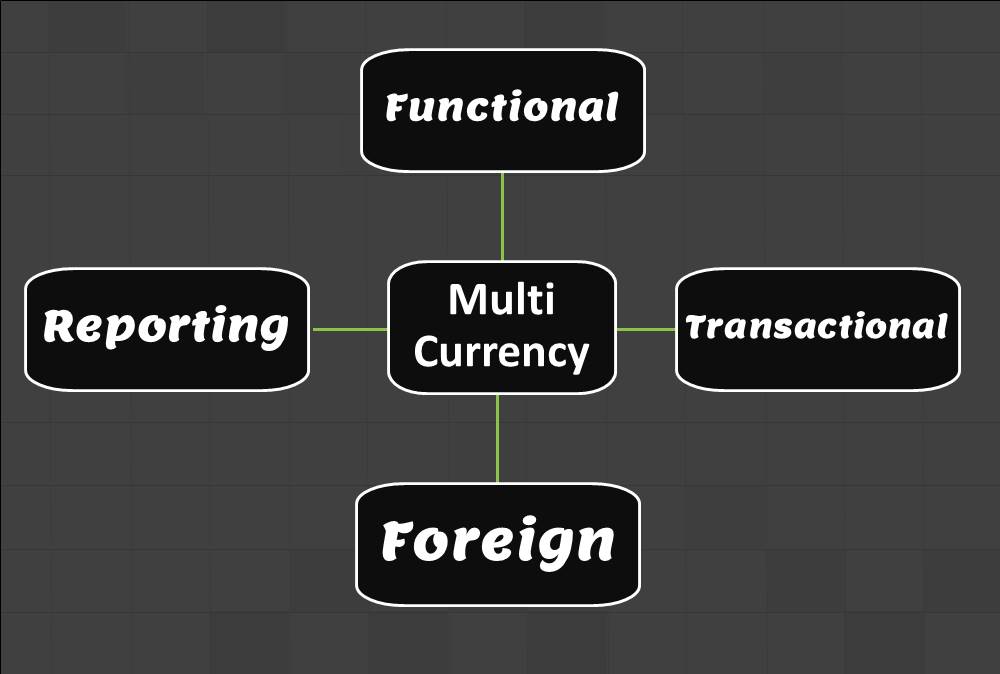

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency, such as functional currency, accounting currency, foreign currency, and transaction currency. Are they the same or different and why do we have so many terms? Read this article to learn monetary concepts.

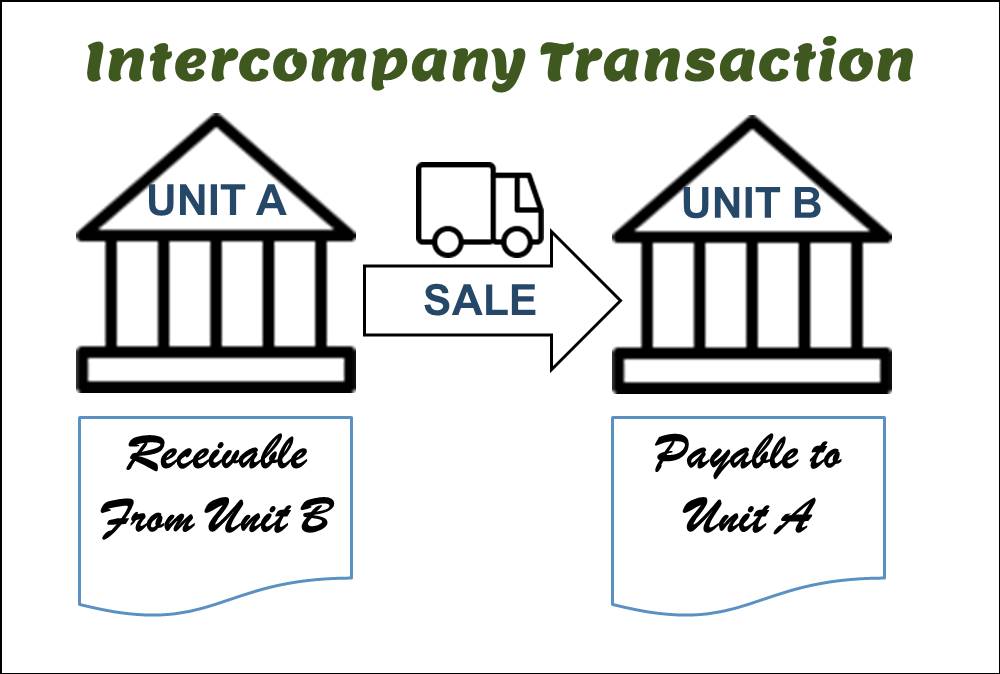

After reading this article, the learner should be able to understand the meaning of intercompany transactions and the different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, distinguishing between upstream and downstream intercompany transactions and understanding the concept of intercompany.

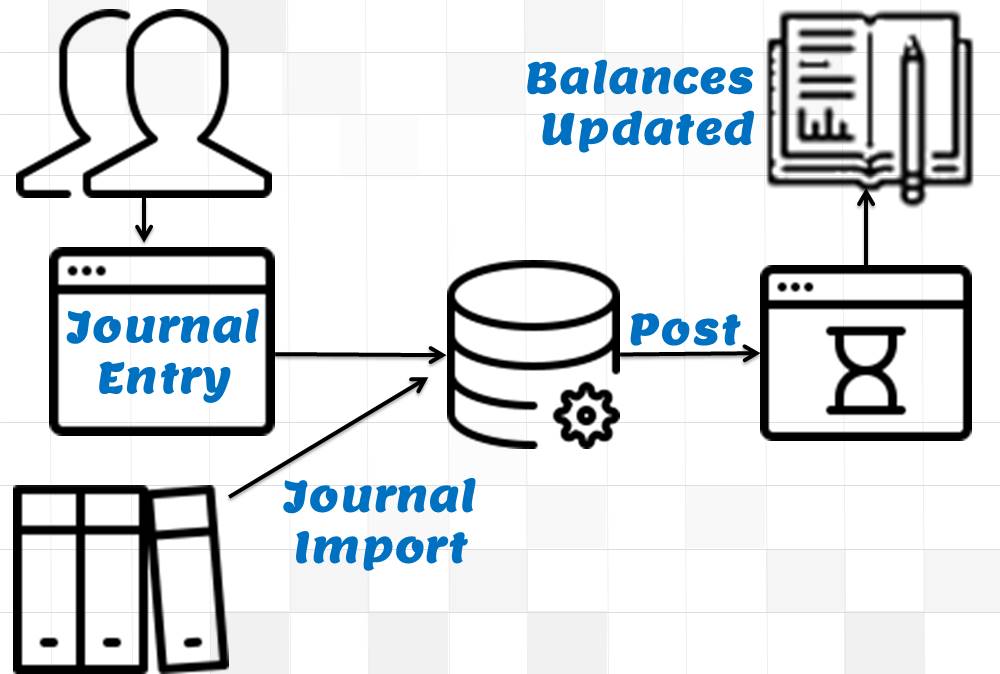

This article explains the process of entering and importing general ledger journals into automated accounting systems. Learn about the basic validations that must take place before accounting data can be imported from any internal or external subsystem to the general ledger. Finally, understand what we mean by importing in detail or in summary.

In this tutorial, we will explain what we mean by posting process and what are the main differences between posting process in manual accounting system versus automated accounting systems and ERP. This article also explains how the posting also happens in the subledgers and later this information is recorded again in the general ledger.