The “Record to Report” process, also known as “Account to Report” or simply General Ledger process, refers to the maintenance of general ledger law from the recording of transactions to the preparation of trial balances for the transaction. unit and consolidated financial results of the reporting company.

Bookkeeping is an essential accounting activity that provides the solid financial foundation on which an organization rests. The accuracy and integrity of the financial statements an organization produces largely depend on the accuracy and integrity of its record keeping activities. Entering journals and reviewing and posting to ledgers are the two main bookkeeping activities. Logs are where all transactions are first recorded on a daily basis. Information from a journal is then recorded in ledgers to update each account. Various accounts in the ledgers are then summarized, tested and validated, and used to produce financial statements at the end of an accounting period.

Here we will help you understand basic accounting concepts and introduce you to the process of entering journals, reviewing, summarizing entries, reconciling, and finally reporting and closing an accounting period. This section of will help you understand the fundamentals of an effective automated general ledger system and the concepts explain all the important GLs including how to analyze a transaction, post it to the appropriate journal, and then view it in great books. We assure you this is the best place to learn the registration process to report!!

Prepayments are the payment of an invoice, operating expense, or non-operating expense that settles an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment of prepaid expenses. Understand the concept by looking at some practical examples and finally learn how to write these expenses.

An account investigation is an examination of any type of financial account, whether it is a deposit account or a credit account. In this tutorial, you will learn what we mean by drill-through functionality in the context of the general ledger system. We will explain the concept of drill down and how it allows users to research accounts and transactions at a granular level and the benefits of using this feature.

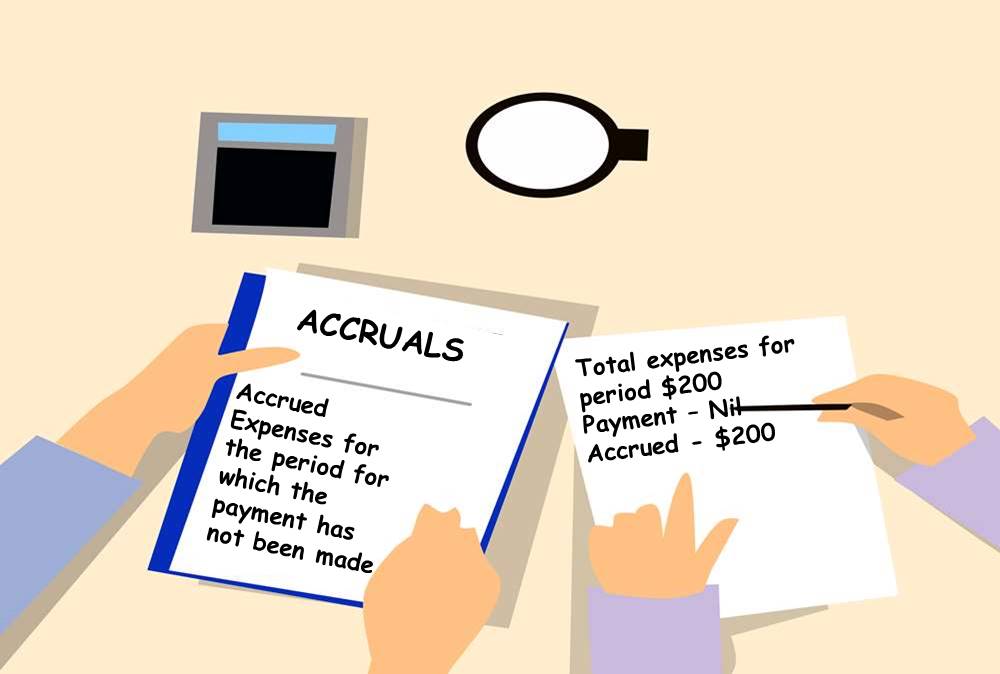

End-of-period rollups, receipt rollups, vacation pay rollups, AP rollups, revenue-based cost rollups, perpetual rollups, inventory rollups, rollups write-offs, purchase order receipt rollups, cost rollups, etc. . are some of the most complex and commonly misunderstood terms in the context of financial accounting. In this article, we will explore what the concept of accrual accounting is and its impact on general accounting.

Accrued revenue (also known as accrued assets) is revenue that has already been earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by accrued income, accrued assets, and unbilled income. Explore the business terms that require recognition of accrued income in the books of accounts and some industries where this practice is prevalent.

In this article, we will describe how to determine if an account needs adjusting entries due to the application of the reconciliation concept. Learners will gain an in-depth understanding of the adjustment process and the nature of adjustment inputs. We will discuss the four types of adjustments resulting from unearned income, prepaid expenses, accrued liabilities, and receivable income.

Understand what we mean by GAAP adjustments to statistics. This article discusses the different standards used for multiple representations of the financial results of global organizations. Understand the meaning of US GAAP, Local GAAP, STAT, IFRS and STAT. Finally, understand why accounting differences arise and how they are adjusted for different financial representations.