BFSI Industry – Domain Knowledge

Looking for knowledge and key business information on the BFSI industry?

brings you BFSI industry overview, business model, value chain, competitive landscape and latest trends. The term BFSI is an acronym for banking, financial services and insurance and popular as an industry term for companies that provide a range of such products/services and is commonly used by IT/ITES/BPO and IT companies. technical/professional services that manage data processing, application testing and software development activities in this field. Banking services can include basic, retail, private, corporate, investment, card banking, etc. Financial services can include stock brokerage, payment gateways, mutual funds, etc. The insurance covers both life and non-life.

Discover the different dynamics and challenges of domain knowledge for BFSI Industry. Rapidly improve your business acumen and speak like an expert and impress your stakeholders at your next meeting!

Custodian intermediaries receive deposits from customers and use the money to run their business. These institutions may have other sources of income, but the daily bread of their business is managing deposits, paying interest on them, and lending money out of those deposits.

As their name suggests, non-custodial intermediaries do not take deposits. Instead, they provide other financial services and collect fees for them as their primary means of business. Learn more about the different types of non-custodial financial intermediaries and how they work.

A financial market is a market where people trade financial securities and derivatives at low transaction costs. A financial market is a word that describes a market where bonds, stocks, securities and currencies are traded. It includes stock markets, index futures, commodities and financial futures. Financial markets exist to bring people together so that money flows where it is needed most. Learn what we mean by financial markets and why we need them? Understand the main advantages offered by these markets and see some examples of different types of financial markets. Understand the difference between primary and secondary markets.

In this article, we will look at the major services provided by banks, insurance companies, mutual funds, stockbrokers, and other financial services firms that make up the financial system. Companies in this sector, which make different financial assets and liabilities more or less attractive to individual investors and borrowers, offer different services.

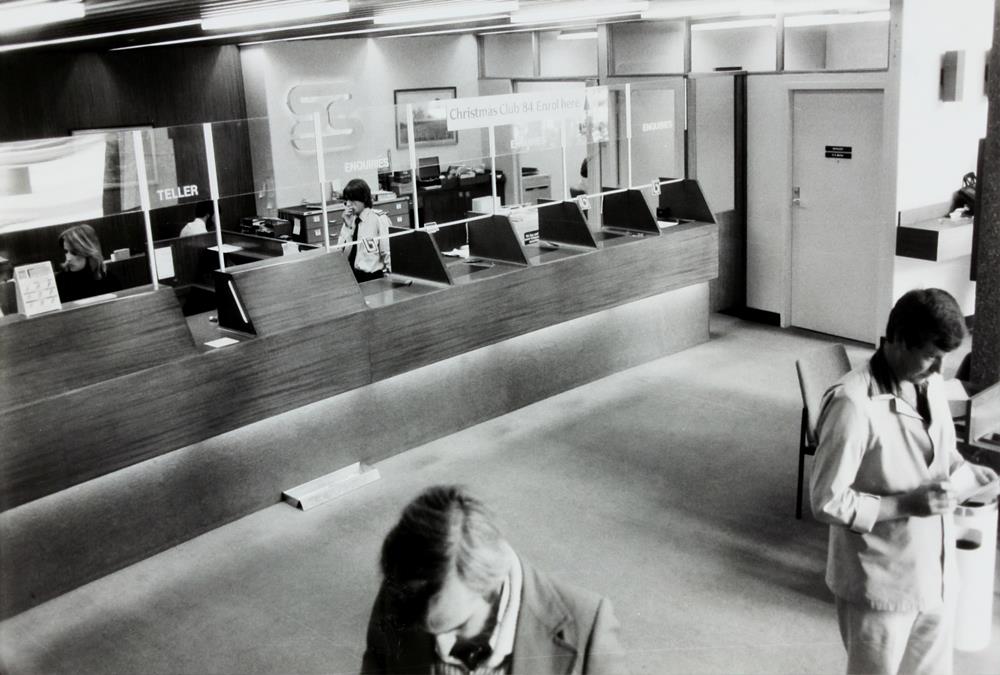

When you think of a bank, what image comes to mind? A bank is a financial intermediary for saving, transferring, exchanging or lending money. Banks issue “currency” – the medium of exchange. A bank is a business and banks sell their services to make money, and they have to market and manage those services in a competitive arena. Learn more about banking fundamentals.

Banks and other institutions play this critical role by providing services essential to the functioning of an economy. Saving, transferring, lending and exchanging money in various forms, as well as assessing the creditworthiness of customers, are the main functions performed by banks. Learn about the role banks play in shaping, their importance in the modern global economy, and why they matter to nations as a whole.

Banks are commercial institutions and, like any other profit-making commercial enterprise, aim to increase their profits by expanding their business. Unlike other stores and shops, banks sell services rather than products. The banking industry is a unique business model and banks have various sources of income such as interest allocation, commissions, fees and other income. Find out how banks get their funds and how they make money on services. In this article, we take a closer look at how banks do business and how they make profits and explore the value chain of the banking industry.

The banking sector is a unique activity and banks are a very important institution for the efficient functioning of the financial system. What are the different components of banks’ balance sheets? What are the different assets and liabilities in their balance sheet? Deposits are assets to anyone who invests them, but how are deposits accepted by a bank represented on the bank’s balance sheet? Explore the answers to these questions and understand the importance of items that are typically part of a commercial bank’s balance sheet. Understand the commercial banking business model from an accountant’s perspective.