What is meant by the word bank? How did the word bank originate? What is the simplest and most concise definition of a bank that explains the fundamentals of the banking process? Does the definition of bank vary from country to country? What are the main differentiators between any other business and a bank? Get answers to all these questions and explore the basics of banking and banking as an industry.

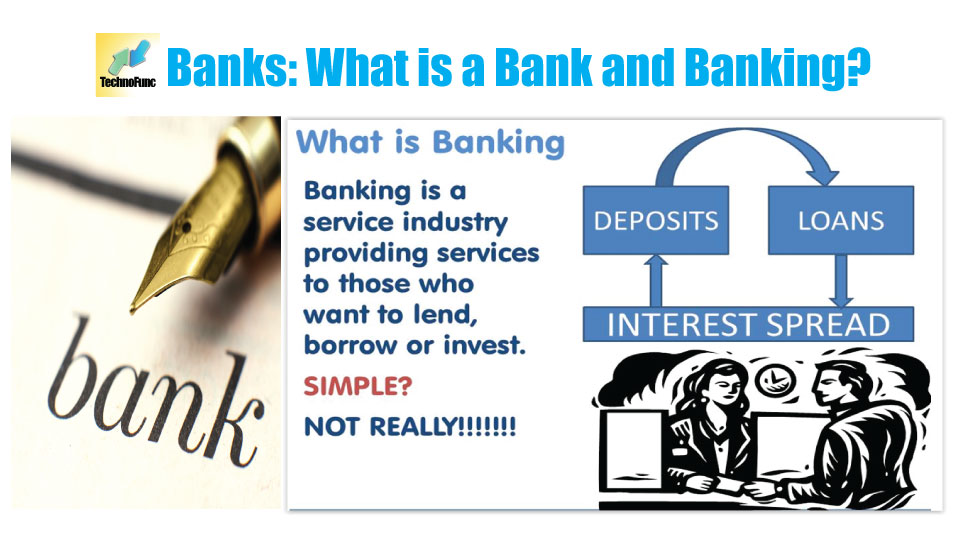

The banking industry is a service industry. It offers various services to its customers. Traditionally, services were limited to deposits and loans. Banks started by taking deposits from people who had excess money and lending that money to others who wanted money for different reasons. Banks charged interest to those who borrowed and returned a portion of the interest earned to those who deposited. The difference in interest rates between deposits and loans was the banks’ main source of income. Therefore, banking is a service industry, which provides services to those who want to lend, borrow or invest.

Origin of the term “Bank”

The term bank apparently owes its origin to the “bank” or bench used by money changers in the Middle Ages. Historically, some banks were called depository banks and mainly held foreign and domestic currency deposits and arranged payment in foreign trade transactions. Other banks created deposits which acted as a means of circulating money in a society. One of the first banks in this category, the Bank of Venice, was created when a group of government creditors banded together and began using public debt as a means of payment in trade.

The term bank apparently owes its origin to the “bank” or bench used by money changers in the Middle Ages. Historically, some banks were called depository banks and mainly held foreign and domestic currency deposits and arranged payment in foreign trade transactions. Other banks created deposits which acted as a means of circulating money in a society. One of the first banks in this category, the Bank of Venice, was created when a group of government creditors banded together and began using public debt as a means of payment in trade.

Origin of the “Bank”

Banking in the modern sense dates back to medieval and early Renaissance Italy, to wealthy northern cities like Florence, Venice and Genoa. The word bank was borrowed into Middle English from Middle French “Banque”, from Old Italian Banca, Old High German banc, meaning “bench/counter”. The benches were used as offices or currency exchange counters in the Renaissance by Florentine banks, which carried out their transactions on desks covered with green tablecloths.

Banking in the modern sense dates back to medieval and early Renaissance Italy, to wealthy northern cities like Florence, Venice and Genoa. The word bank was borrowed into Middle English from Middle French “Banque”, from Old Italian Banca, Old High German banc, meaning “bench/counter”. The benches were used as offices or currency exchange counters in the Renaissance by Florentine banks, which carried out their transactions on desks covered with green tablecloths.

Evolution of the bank

The banking sector may have started like this, but today the banking sector is one of the most complex and diverse business enterprises offering a portfolio of a large number of services. Commercial banks are an important stimulus to the economy by managing institutional credit to their customers. Banks today are large and complex organizations. Their customers range from individuals and businesses to other banks and governments of entire nations. Banking is a service industry, which means that it does not manufacture physical products but provides services to its customers. They deal with all types of monetary transactions, borrow it, lend it and many other related activities which will be explained in this series.

The definition

The definition of a bank varies from country to country. According to English common law, a banker is defined as a person who carries on business as current bank accounts for his clients, paying checks drawn on him and cashing checks for his clients. While in some legal enactments in India, the banking corporation is defined as one that carries on the business of banking, which means accepting, for lending and investment purposes, deposits of money from the public, repayable on demand or otherwise and withdrawals by cheque, draft, order or otherwise. Let us now dive into some known definitions of banking given by established authors and various statues and try to examine the gist of “banking” inferred in these definitions.

The definition of a bank varies from country to country. According to English common law, a banker is defined as a person who carries on business as current bank accounts for his clients, paying checks drawn on him and cashing checks for his clients. While in some legal enactments in India, the banking corporation is defined as one that carries on the business of banking, which means accepting, for lending and investment purposes, deposits of money from the public, repayable on demand or otherwise and withdrawals by cheque, draft, order or otherwise. Let us now dive into some known definitions of banking given by established authors and various statues and try to examine the gist of “banking” inferred in these definitions.

1. “A banker is defined as a person who engages in the business of banking, which is defined as follows: current accounts for his clients, payment of checks drawn on him and cashing of checks for his clients.

English common law2. “A banking company is one which exercises banking activity, that is to say accepts, for loan and investment purposes, deposits of money from the public, repayable at sight or not and withdrawals by checks, drafts, money orders or otherwise. “

“By bank is meant the acceptance, for loan or investment purposes, of deposits of money from the public, repayable at sight or otherwise and which may be withdrawn by check, draft, money order or otherwise.

Banking Regulation Act; India3. “A banker is one who, in the ordinary course of his business, honors checks drawn on him by persons from whom and for whom he receives money in current accounts.”

Herbert L. Hart4. “The function of receiving money from its customers and repaying it by honoring their checks as and when required is the function above all other functions which distinguishes a banking business from any other type of business. ‘company.”

HP Seldon5. “A bank is a financial institution and a financial intermediary that accepts deposits and channels these deposits into lending activities, either directly by lending or indirectly through capital markets. A bank is the link between capital-short customers and capital-surplus customers.

Definition by Wikipedia6. “No one can be a banker, legal person or not, who does not hold deposit accounts, hold current accounts, issue and pay checks and cash checks, crossed and uncrossed, for his clients.

Mr John Paget7. “banking business” means the business of receiving money into a current or deposit account, paying and cashing checks drawn or deposited by customers, making advances to customers, and includes any such other activity as the authority may prescribe for the purposes of this Act; »

Singapore Banking Act8. “A money safekeeping establishment, which it disburses at the order of the client.”

Definition of bank according to the Oxford dictionary

Distinctive features of a bank

From the discussion above, you can identify some of the distinguishing characteristics of a bank, which we have highlighted below:

Bank is an institution that deals with money

Accepting deposits of money from the public

It mobilizes people’s savings

Loan or invest money

Profitable use of these funds

Makes funds available to businesses, financing their capital expenditure and revenue

Provides financial services for a price, i.e. interest, discounts, commissions, etc.

Not expected to repay the money of their own free will

For refunds, the depositor must make an appropriate request for a refund of money

Obligation to repay deposits on sight

Trading in financial instruments

Banking as main activity

A bank stimulates economic activity in the market by processing money

Key points to remember

Here are some other key points that emerge from the discussion above:

Here are some other key points that emerge from the discussion above:

Banks mobilize resources by accepting deposits and use these funds by employing them profitably. The banker is therefore an intermediary and deals with the public’s money.

The taking of deposits, of money, is an essential function, however, just because a business takes deposits of money from the public, that does not make it a banker. It is necessary that the accepted deposits are also used for loans or investments. Currently, industrial units, large trading houses and other business enterprises are also accepting deposits from the public with the ability to withdraw them when needed or after the expiration of a certain lock-up period. However, these institutions cannot be called bankers because taking deposits is their subsidiary activity while the main function is manufacturing or trading.

Similarly, if a commercial enterprise exercises a banking activity only as ancillary to the same other main activity, it cannot be considered a bank.

In addition to deposits and lending or investing funds, banks also perform various ancillary services such as the cashing of cheques, drafts, bills of exchange, interest and dividends on securities, payment on behalf of its customers, the remittance of funds, the discounting of exchange drafts, the acceptance of valuables in a safe place, etc.

Finally, we can summarize that the “Bank” is an institution that accepts deposits, grants loans, pays checks and provides financial services. One of the primary roles of banks is to connect holders of funds, such as investors and depositors, with those seeking funds, such as individuals or businesses in need of loans. In the whole process, it generates income and stimulates the economy.

Banking Knowledge – Resources

Related links

History of Banking: The Gold Standard and the Fractional Reserve Changing Banking Landscape and Impact on Country-Specific Strategy | The opportunity of electronic signatures in the banking sector | Migration of banking customers to digital channels | Regulatory Compliance/Risk – Example – Basel III | Banking Sector Value Chain – Economic Benefits of the Banking Sector

Creation Date Monday, July 2, 2012 Views 58557