Costs related to plant assets that are incurred after the asset is placed in service are either added to the fixed assets account (capitalized) or charged to operations (expensed) when incurred. In this article, we will discuss the principles behind this accounting event.

Most operating assets require expenditure to repair, maintain or improve them. These substantial costs can pose accounting problems if they are of a significant amount or significantly affect the life of the asset. The FA accountant is faced with the choice between capitalizing it and expensing it in the year it occurs.

Cost Components

The cost of an item of fixed asset comprises its purchase price, including import duties and other non-refundable taxes or levies and any directly attributable cost to bring the asset into working order for the use for which it is intended. he is destined ; All trade discounts and rebates are deducted to arrive at the purchase price.

The following are examples of directly attributable costs:

- site preparation;

- initial delivery and handling charges;

- installation cost, such as special foundations for the plant; and

- professional fees, for example fees for architects and engineers.

The cost of a fixed asset may be subject to variations subsequent to its acquisition or construction due to exchange rate fluctuations, price adjustments, changes in duties or similar factors.

Administrative and other general expenses are generally excluded from the cost of fixed assets because they do not relate to a specific fixed asset. However, in certain circumstances, expenditures specifically attributable to the construction of a project or to the acquisition of a fixed asset or its bringing into working order may be included in the cost of the construction project or in the cost of immobilization. Expenses incurred for the start-up and commissioning of the project, including expenses incurred for testing and experimental production, are generally capitalized as an indirect element of the cost of construction. However, expenses incurred after the plant has started commercial production, i.e. production for sale or captive consumption, are not capitalized and are treated as revenue expenses even if the contract may stipulate that the plant will only be definitively taken over after satisfactory completion.

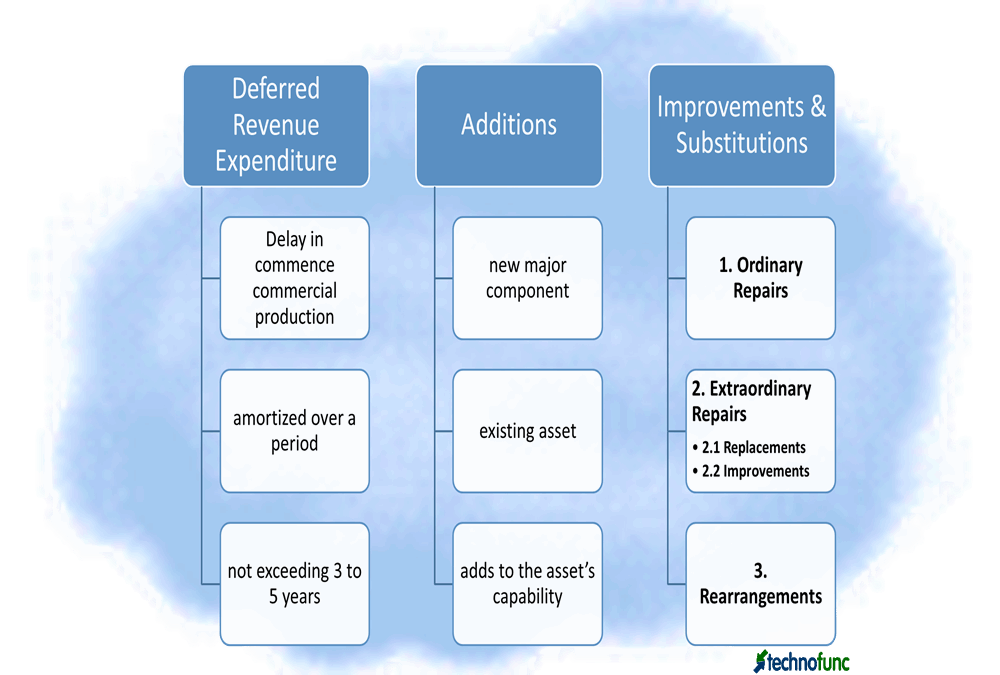

Deferred income expenses

If the interval between the date on which a project is ready to begin commercial production and the date on which commercial production actually begins is extended, all expenses incurred during this period are charged to the income statement. However, expenses incurred during this period are also sometimes treated as deferred revenue expenses to be amortized over a period not exceeding 3 to 5 years from the start.

Redevelopment and relocation costs are generally deferred as a separate asset and amortized against future revenues.

Additions to fixed assets

Additions are the expenses incurred to add a major new component to an existing asset; generally adds to the capacity of the asset but does not extend its useful life. Additions lead to the creation of new assets, they must be capitalized. The cost of an addition or extension to an existing asset that is capital in nature and becomes an integral part of the existing asset is generally added to its gross book value. Any addition or extension, which has a separate identity and is likely to be used after the disposal of the existing asset, is accounted for separately

Improvements and replacements

Upgrades and replacements are substitutions of one asset for another. Enhancements substitute a better asset for the one currently in use, while a replacement replaces a similar asset. The major problem in accounting for improvements and replacements is to differentiate these expenses from normal repairs.

Enhancements and substitutions may fall into one of the categories below:

1. Ordinary repairs

Expenditures made to maintain the utility of the asset at an appropriate level; does not add to the useful life or capacity of the asset.

2. Extraordinary Reparations

Expenditure made to improve the usefulness of the asset Includes:

2.1 Replacements

Expenses incurred to substitute a major new component for an existing component; generally extends the useful life of the asset, but not its capacity.

2.2 Improvements

Expenses incurred to substitute a new improved major component for an existing component; generally extends the useful life of the asset and increases its capacity.

3. Redevelopments

Expenses incurred to restructure the asset without addition, replacement or improvement; the goal is to create new capabilities, but not necessarily to extend useful life.

A truck may have an engine that needs to be replaced. Engine replacement represents a “restoration” of part to original condition (similar to “depreciation”). Restoration and upgrade type costs are considered to qualify for activation due to the life/quality upgrade.

Accounting treatment

For costs to be capitalized, one of three conditions must be met:

(a) The useful life of the asset needs to be increased/extended. For example, the expected life of the asset is long after the investment.

(b) The quantity of service produced from the asset must be increased. The capacity or productivity of the equipment increases. Production units are higher.

c) The quality of the units produced must be improved. The quality of the output is improved in some way. The units produced contain features that did not exist before the investment.

In general, costs incurred to obtain greater future benefits from the asset should be capitalized. It should only be capitalized if an improvement or replacement increases the future service potential of the asset.

Capitalization can be achieved by:

(a) By substituting the cost of the new good for the cost of the replaced good,

(b Capitalize the new cost without eliminating the cost of the replaced asset, or

(c) Allocation of Expenses to Accumulated Amortization.

Often, it is difficult to determine whether a capital expenditure represents improvements that should be added to the gross book value or repairs that should be charged to the income statement. Only an expense that increases the future benefits of the existing asset beyond its previously assessed level of performance is included in the gross book value, for example, an increase in capacity. The specific facts of the situation will help determine the most appropriate method to use.

Expenses that simply maintain a given level of service, such as normal repairs, should be expensed. Subsequent expenditures on an item of an asset should only be added to its carrying amount if they increase the future of the existing asset beyond its previously assessed level of performance.

Most fixed assets require substantial ongoing costs to keep them in good condition. The accounting rules for these costs treat them as “capital expenditure” if future economic benefits result from the expenditure. Future economic benefits occur if the useful life of an asset is extended, the quantity of services expected from an asset is increased, or the quality of services expected from an asset is improved.

In many cases, a considerable amount of judgment is required in deciding whether to capitalize or expense an item. However, the application of a capital/expenditure policy is more important than the attempt to provide normally consistent theoretical guidelines.

Related links

Creation date Sunday, August 02, 2020 Views 2399