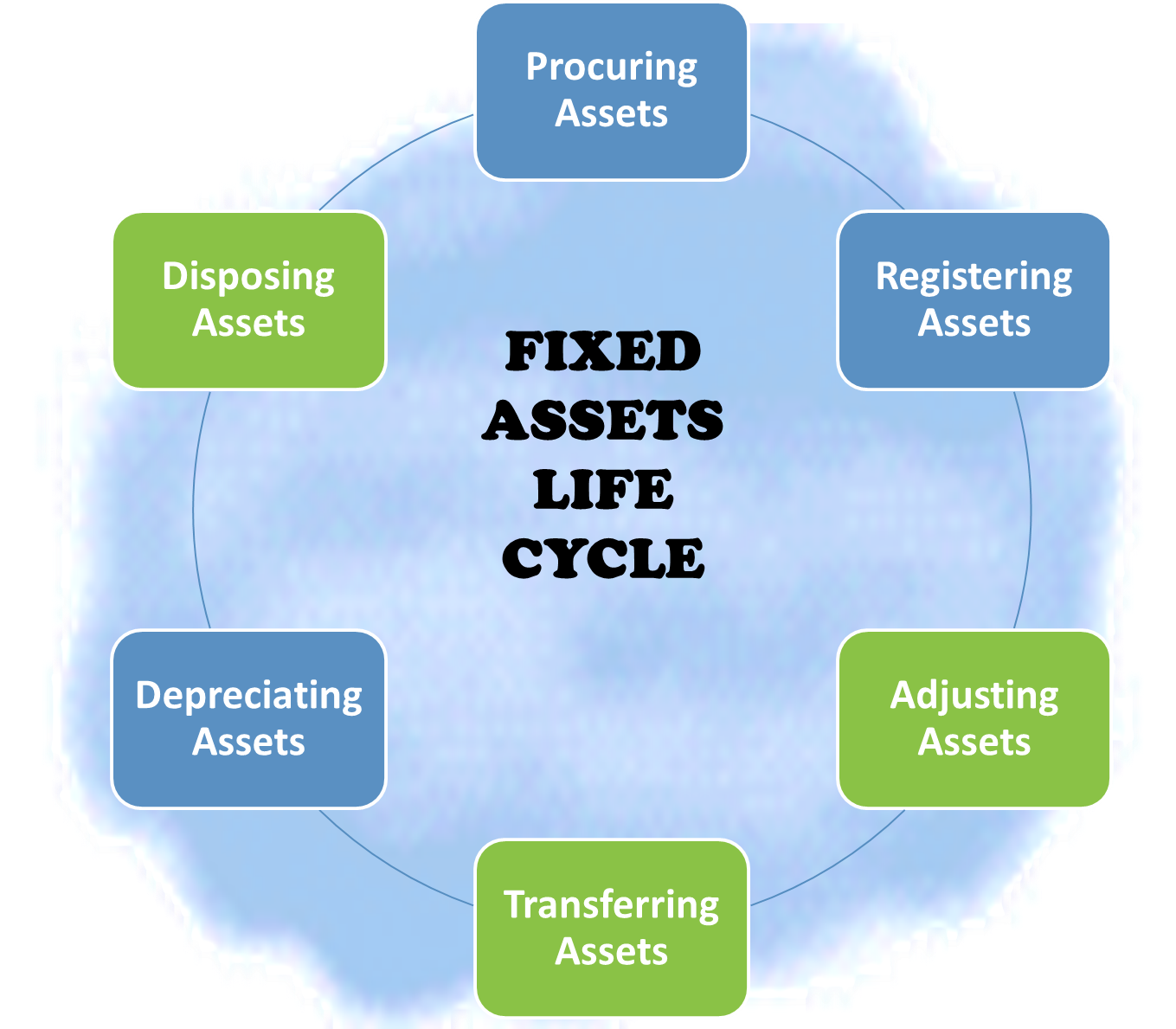

“Fixed Assets” is a six-step process and begins with the initiation and approval of the application for the acquisition of the asset and after the maintenance and amortization for the useful life ends with the final disposal of the asset. ‘immobility. These stages are cyclical in nature and most of them occur in any fixed management life cycle. Some optional steps may only occur in certain business scenarios or in specific industries.

The steps of the process or the rafters of the “Fixed Assets” process can be summarized as follows:

- Throw

- Acquire – Acquire an asset

- Maintain – Save/Add Asset

- Depreciation/appreciation of assets

- Eliminate and withdraw – Transfer / Adjust / Eliminate

- Report

1. Run:

The immobilization process typically begins with an approved immobilization request (A/R). Anyone authorized to request an asset prepares an Appropriation Request (AR) form providing details of the requested asset and submits it for review and approval.

2. Acquire – Procure an asset:

A fixed asset can be a self-built asset or it can be an acquired asset. Once the RA is approved, a purchase order is issued in case the asset needs to be purchased from a vendor. An asset is most often entered in the accounting system; when the invoice for the property is entered; in accounts payable; or the system purchase module. Assets can also be entered directly into the fixed asset management system.

3. Maintain:

Most organizations need to manage hundreds or even thousands of physical assets. In such a case, it is important to know the working condition and location of the assets they own at periodic intervals. Identifying, tracking and controlling assets is a critical step in “asset maintenance”. Saving or adding an asset: Most of the information needed to set up the asset for depreciation is available at the time of invoice entry. Information captured at this stage includes; acquisition date, commissioning date, description, asset type, cost basis, depreciation basis, etc. Some information will automatically flow based on the selected asset type based on relationships that need to be defined in the system.

Sometimes a fixed asset is transferred to another subsidiary, reporting entity or department within the company. These inter-company and intra-company transfers may result in changes that impact the asset’s depreciable basis, depreciation, or other asset data. This must be accurately reflected in the fixed asset management system

4. Cushion:

The decline in the economic and physical value of an asset is called depreciation. Under GAAP, depreciation is an expense that must be reflected periodically in a company’s books, depending on the accounting periods, to match income and expenses. Sometimes the revaluation of an asset can also cause its value to appreciate. The cost of an asset must be spread rationally and systematically over the periods of its useful life. Advanced FA accounting systems automatically calculate depreciation each month based on information established in each fixed asset record. The system may have the ability to calculate separate depreciation for corporate GAAP, local GAAP, and tax purposes. Adjustments to information about existing assets are often necessary to deal with events that may change the depreciable basis of an asset. There may be improvements or repairs made to assets that add value to the asset or extend its economic life.

5. Eliminate and remove:

Items of capital assets that have been removed, are not in use, are obsolete or beyond repair, or are identified as being removed from active use are held for disposal. When an asset is taken out of service, no depreciation can be charged to it. An item of an asset is eliminated from the financial statements on disposal and any gain/loss resulting from disposal/scrapping should be recognized in the income statement. When a fixed asset is, is no longer in use, becomes obsolete, is beyond repair, the asset is generally disposed of. When an asset is taken out of service, no depreciation can be charged to it. There are several types of disposals, such as abandonments, sales and repossessions. Any difference between the carrying value and the realized value is accounted for as a gain or a loss.

6. Reports for fixed assets:

The reporting and compliance planning needs of “fixed assets” for multinational corporations are varied and complex. There are a multitude of depreciation methods and different regulations/statutes prescribe different rates and methods for calculating depreciation for the same asset. A business must prepare financial (US GAAP), statutory (Local GAAP), and fiscal (income tax, property tax, VAT, GST) amortization schedules and compliance reports. The financial analysis system should provide the ability to account for these different dimensions and the ability to perform analytical reviews. At the end of the month, the accounting period in the FA system is closed and the FA system transfers the monthly fixed asset activity to the G/L. Reconciliations should be made between the FA sub-ledger and the G/L for all fixed asset accounts. Generate all fixed asset reports needed to complete the closing process.

Related links

Creation Date Thursday, June 13, 2013 Views 41068