In this article, we have explained the meaning and usage of key generic terms that are used in almost all FA management systems / fixed assets processes. Understanding these terms is a prerequisite for gaining a solid understanding of the fixed assets business process.

Meaning of fixed assets

An asset is a basic unit of economic value that is expected to provide benefits beyond a single period. The value of the asset is recorded on the company’s balance sheet. Examples of assets are cash, accounts receivable, inventory, prepaid insurance, land, buildings, equipment, trademarks and certain deferred charges. There are two major asset classes; tangible assets; and intangible assets. Property, plant and equipment are classified as follows; current assets or fixed assets. Current assets include inventory and receivables while fixed assets include buildings, property, equipment, land, machinery, and equipment.

Fixed assets management

Asset management refers to the system for monitoring and maintaining assets effectively and efficiently. It applies to both tangible and intangible assets. Asset management is a systematic process of operating, maintaining and upgrading assets in a cost-effective manner. Enterprise asset management refers to the business processes that support the management of an organization’s assets.

Asset Allocation Request (A/R)

The immobilization process typically begins with an approved immobilization request (A/R). Anyone authorized to request an asset prepares an Appropriation Request (AR) form providing details of the requested asset and submits it for review and approval.

Asset class

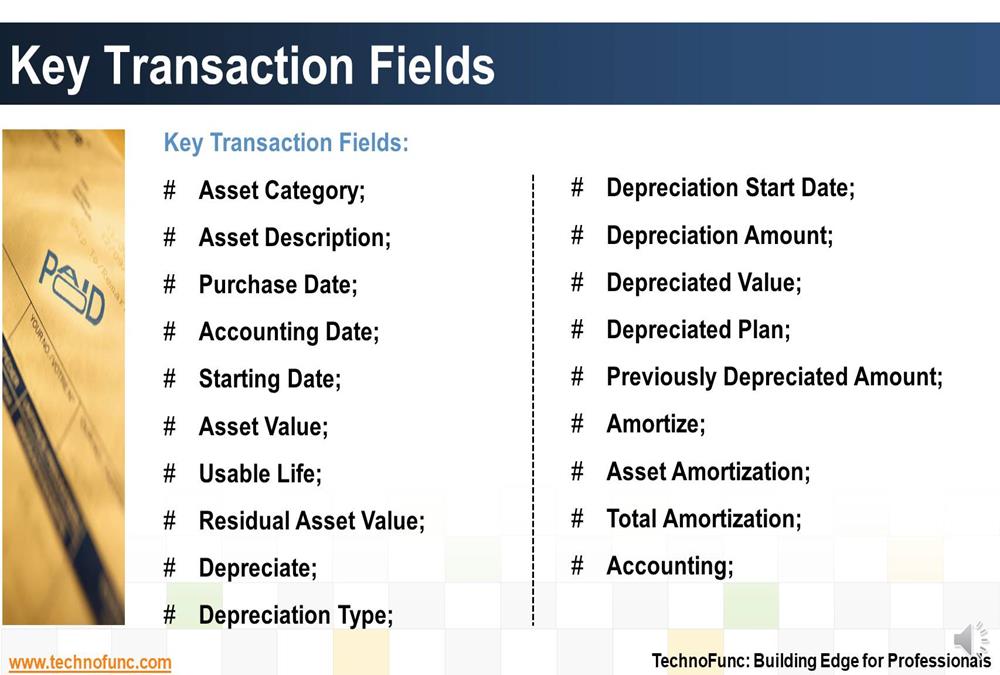

Assets are grouped belonging to the same category so that they can inherit certain common properties. Selecting the asset class inherits the accounting properties of the underlying class.

Description of the asset

Asset description or enter notes to identify the nature of the asset, its location or other useful attributes for easy recognition and identification.

date of purchase

The date the asset was purchased. This data is useful for many examples of accounting events to find the capitalization date and in some cases to start charging depreciation to the asset.

Accounting date

The date used to determine which period this post belongs to in the general ledger. The accounting date is the date on which the asset is formally recorded in the accounting system. Start date. Determine the start date for which depreciation is calculated. This is the date from which depreciation will be charged.

Historical cost / asset value

This represents the initial value of an asset. Capture the original cost of the asset to ensure history is available for reconciliation and auditing purposes. The costs recognized for each asset acquired include the purchase price and everything necessary to make it production-ready. All expenses associated with acquiring an asset and preparing it for use are capitalized as part of the original cost. Included are the price charged for the asset, transportation costs and installation costs, including any construction or alterations to the building necessary to house it. Other soft costs are sales or use taxes, duties on imported items, and initial testing and installation costs. The full costs of acquiring and actually bringing the asset into production must be capitalized.

Useful life

The useful life of the asset represents the expected life of the asset when it is expected to provide economic value to the business. It is calculated in years or months and generally used to depreciate the asset.

Residual value of the asset

This represents the value of the asset at the end of the amortization period. This is the expected value of the asset once its useful life is over. Sometimes this can represent the salvage value of the asset. Scrap is the value of the individual components of a physical asset when the asset as a whole is considered no longer usable. The scrap value of an item is determined by the supply and demand of the materials into which it can be broken down and the scrap asset can have some monetary value.

Type of damping

There are different methods for calculating the depreciation of fixed assets. It must be determined which depreciation method will be used to calculate the depreciation of the fixed asset.

Amortization start date

Date from which to calculate depreciation entries

Depreciation amount

This indicates the amount of the initial value to be depreciated. Most of the time, it is a calculated value based on the depreciation period and rate. The cost of an asset must be spread rationally and systematically over the periods of its useful life. Advanced FA accounting systems automatically calculate depreciation each month based on information established in each fixed asset record. The system may have the ability to calculate separate depreciation for corporate GAAP, local GAAP, and tax purposes.

Depreciated value

A term indicating the portion of the depreciation value that has already been posted to the general ledger. Depreciation is posted on a periodic basis and this depreciated value is used to track these entries.

Amortized plan

Term indicating the value of the asset that will be depreciated until the end of the life of the asset

Amount previously amortized

The amount that has already been depreciated before the asset entered the system

Dampen

Usually a checkbox to define whether depreciation is calculated

Depreciation of assets

Depreciation follow-up

Total amortization

Term identifying the total amount of depreciation displayed for a selected period

Asset Accounting

Specific accounting parameters relate to an asset, such as the different charts of accounts that will be used for that particular asset.

markup

Once the asset is purchased/commissioned, the organization affixes asset tags with descriptive information such as asset number, expense code, asset description, cost center, and a bar code.

Physical verification

All entities perform a physical count of all fixed assets at periodic intervals (ranging from 1 to 5 years) to verify the actual assets on hand and their value and to ensure the accuracy of related financial records.

Review of dormant assets

Organizations strive to make full use of fixed assets in their possession and control. Therefore, they should strive to identify and make available unused, surplus, and underutilized equipment for other departments that may need it.

impairment

An impairment exists when the carrying value of an asset exceeds its fair value and is not recoverable. Specific events/changes could trigger an impairment of an asset such as a significant decline in the market price of a fixed asset, a change in the way the business uses an asset or changes in the business climate which could affect the asset value.

Asset adjustments

Adjustments to existing asset information are often required. Events can occur that change the depreciable basis of an asset, such as improvements or repairs to assets that add value to the asset or extend its economic life. Expenditures that increase the future benefits of the existing asset beyond its previously assessed level of performance are included in the gross book value, for example an increase in capacity.

Revaluation of assets

The purpose of a revaluation is to bring to the books the fair market value of fixed assets. Events may occur that cause the organization to revalue its assets if there is a change in the value of the assets due to inflation, deflation or appreciation.

Principle of reconciliation:

The matching principle of accounting calls for the matching of costs with the accounting period from which those costs benefit. The purpose of recording historical costs is to ensure that the costs incurred in purchasing assets in a past accounting period will be allocated to future accounting periods that benefit from them.

Key Roles in Fixed Asset Management

The key organizational roles that are typically required to manage the capital asset process begin with the requisitioner who is typically the end user needing the particular asset. The request is placed with the Procure-to-Pay department to acquire the asset in accordance with company policies and ensure payment is made for the asset. A fixed asset can be a self-built asset or it can be an acquired asset. Once the RA is approved, a purchase order is issued in case the asset needs to be purchased from a vendor. The finance department permanently manages the accounting and depreciable aspects of the assets. Most organizations need to manage hundreds or even thousands of physical assets. In such a case, it is important to know the working condition and location of the assets they own at periodic intervals. Identifying, tracking and controlling assets is a critical step in “asset maintenance”

Related links

Creation date Saturday 01 August 2020 Hits 2585