Most organizations need to manage hundreds or even thousands of physical assets. In such a case, it is important to know the working condition and location of the assets they own at periodic intervals. Identifying, tracking and controlling assets is a critical step in “asset maintenance”.

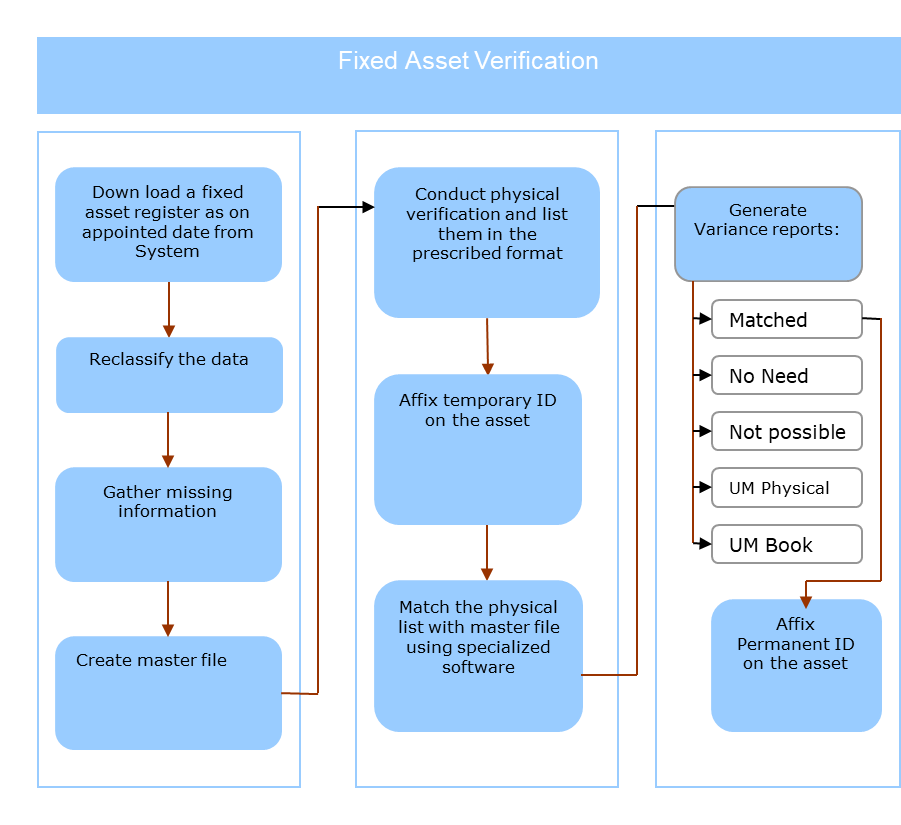

Tracking of available physical assets such as furniture and fixtures, plant and machinery, IT assets, etc. and compare with the fixed assets register. The tracking process is done by proper labeling of the assets using a barcode or any other human readable number. Generate various reports and take corrective actions

Asset tagging

Once the asset is purchased/commissioned, the organization affixes asset tags with descriptive information such as asset number, expense code, asset description, cost center, and a bar code.

Markup best practices:

- Affix a temporary ID at the time of physical registration

- Create a permanent ID for matching assets after the matching process using the system asset number.

- Permanent identification will be printed on flexible labels like barcode sticker, metal plates, etc. which will conform to the asset, which will also withstand harsh conditions including chemicals, abrasion, solvents and high temperatures.

- The tag used should provide easy tracking, accurate and reliable readings for years to come.

- The size and type of tag should be decided based on the nature of the asset

- Approved size and type tag must be affixed to matched assets

- Update cost center, location, machine serial number, part number, etc. in the system

- Update inventory details in the system for future reference

- Ensure authenticity of depreciation calculation for income tax and corporation law purposes

- Correct values for each location for insurance purposes

- Suggest changes in the standard operating procedure for asset capitalization, transfer and disposal to ensure online update in the system

Physical verification:

All entities perform a physical count of all fixed assets at periodic intervals (ranging from 1 to 5 years) to verify the actual assets on hand and their value and to ensure the accuracy of related financial records. Asset PV helps identify obsolete, abandoned, and unused assets, control capital expenditures, obtain third-party confirmation letters, and take corrective action on unmatched assets.

1. Unparalleled strengths

- Funding available but not found in asset register

- Available in Asset Registry not physically found

Reason for identified discrepancy

- Not possible to verify

- Physically scrapped/disposed of not removed from asset register

- Low value assets

- Assets available from third parties

2. Review of dormant assets:

Organizations strive to make full use of fixed assets in their possession and control. Therefore, they should strive to identify and make available unused, surplus, and underutilized equipment for other departments that may need it.

Adjustments after verification

A. Impairment:

An impairment exists when the carrying value of an asset exceeds its fair value and is not recoverable. Specific events/changes could trigger an impairment of an asset such as a significant decline in the market price of a fixed asset, a change in the way the business uses an asset or changes in the business climate which could affect the asset value.

B. Asset adjustments:

Adjustments to existing asset information are often required. Events can occur that change the depreciable basis of an asset, such as improvements or repairs to assets that add value to the asset or extend its economic life. Expenditures that increase the future benefits of the existing asset beyond its previously assessed level of performance are included in the gross book value, for example an increase in capacity.

C. Revaluation of assets:

The purpose of a revaluation is to bring to the books the fair market value of fixed assets. Events may occur that may cause the organization to revalue its assets if there is a change in the value of the assets due to inflation, deflation or appreciation.

Related links

Creation date Saturday 01 August 2020 Hits 2611