A fixed asset register (FAR) is an accounting book with a list of fixed assets owned by a particular entity. Traditionally, the fixed assets register was kept in written form by the accountant using a book reserved specifically for monitoring fixed assets. Now, with the advent of computer systems for accounting, it is more often kept in electronic form. Learn the importance of maintaining a FAR.

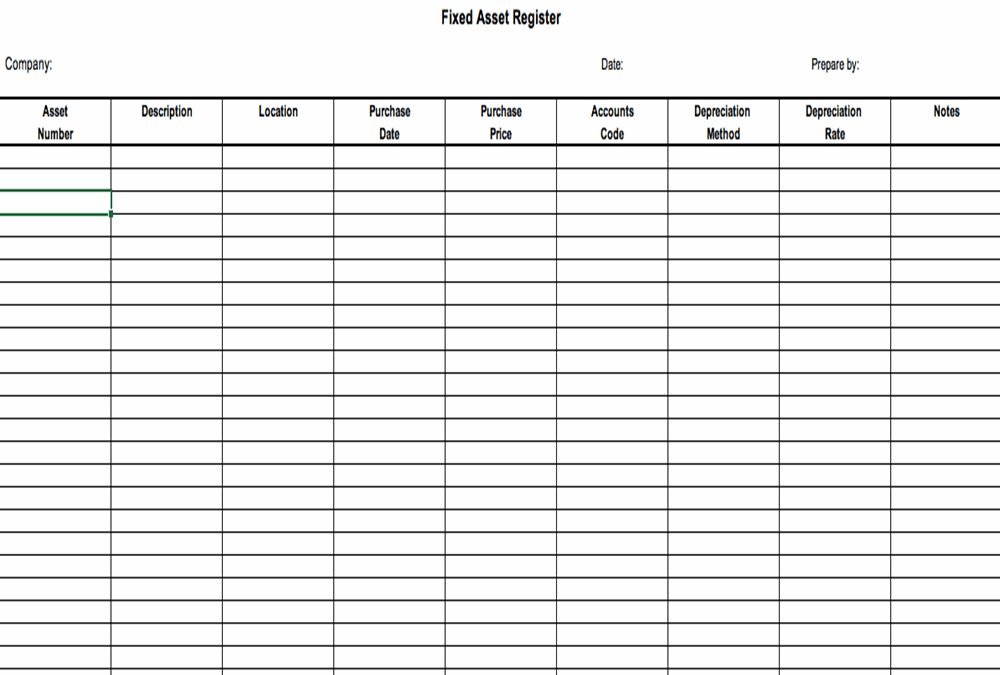

A fixed assets register is an itemized list of all fixed assets owned by the business. It should include details such as:

- Description of the asset

- Asset location with business unit

- Price and date of purchase

- The useful life of the asset

- Date of commissioning

- Expected value at the end of its useful life

- Depreciation expense (cumulative and current)

- Asset block and asset class, if applicable

- Gross book value and net book value

FAR and ledger

The main purpose of a fixed asset register is to track the book value of assets and determine the depreciation to be calculated and recorded for management and tax purposes. Maintaining an up-to-date and accurate fixed asset register helps not only to ensure compliance, but also to plan short- and long-term capital investments.

In addition, it is important to keep a fixed asset register because it allows companies to track the book value of assets and their depreciation over time. The ledger only has the total account balances and the amortization balance for a particular asset class and the transactions in summary. It does not contain full details of the individual assets that make up the total asset class and no details of the depreciation of each of these individual assets. Having so many details in the GL would clutter it up too much. So it’s best to have the asset line-level details in a separate place. In large organizations, FAR is maintained by asset management systems or software solutions. The FAR serves as the FA sub-ledger for all accounting purposes.

Assets not under direct control

It also records fixed assets that are not under the direct control of the business, such as leased assets, assets under construction, and imported assets.

In accordance with the laws

Tax and accounting laws require the keeping of this register. By tracking every movement of every fixed post, the FAR ensures better control and avoids hijacking. It allows the calculation of depreciation and for tax and insurance purposes.

Management reports

With the help of an FAR, reports such as location of assets, value of individual assets in an asset class, depreciation of each asset in the class, value of assets under construction or leased assets , etc. can be generated, allowing management to make capital budgeting decisions. FAR also helps estimate future capital investment in fixed assets and determine business valuations in the event of mergers or acquisitions.

Reconciliation of Fixed Assets

At the end of each month/quarter (depending on company policy), the relevant GL and FAR reports are extracted to perform the FA reconciliation. The total for each asset class in the GL should equal the sum total of the individual assets in that class, as provided by the FAR. In case the two do not match, the reasons are analyzed and necessary measures are taken to balance the two.

In addition, the total depreciation according to the depreciation plan must be linked to the depreciation balance in the GL, which is calculated based on the block of assets and not on an individual asset. If there is a mismatch between depreciation amounts, a reconciliation is required to identify and resolve the discrepancies.

This is important to ensure that the FA GL balance reported in the balance sheet is correct and accurate.

Identification of assets

A secondary purpose is to allow easy identification of an asset by assigning each asset a unique identifier that can be printed on labels in the form of a barcode. FAR also helps in estimating repair and maintenance costs. In some countries, subsidies are allowed on certain assets. The value of assets is determined by fixed asset records.

Physical verification of assets

Besides the GL and sub-ledger reconciliation, there is a physical FA verification. Assets are physically checked for quantity and location according to FAR details. This is usually an annual process.

Related links

Creation date Sunday, August 2, 2020 Views 2285